About Us

AD Investment Management (ADIM) is a specialized Middle Eastern asset management boutique that is supported by a globally leading sovereign wealth fund.

ADIM’s mission is to provide clients, communities, capital markets and

shareholders with sustainable investment solutions by committing smart people, independent financial thought and disciplined processes.

AD Investment Management is domiciled at the Abu Dhabi Global Market and regulated by the ADGM’s Financial Services Regulatory Authority (FSRA). AD Investment Management was founded in 2019 as a subsidiary of the Abu Dhabi Investment Company (Invest AD).

Abu Dhabi Investment Company was established in 1977, by decree of the late President of the UAE, HH Sheikh Zayed Bin Sultan Al Nahyan.

Philosophy & Culture

Our diverse experiences and backgrounds inspire us to challenge implied market assumptions and to uncover new insights. The following six cornerstones of our investment philosophy are adhered to by all members of the team

Our idea generation process is primarily bottom-up, based upon proprietary company-specific research.

As often as possible, we will ensure that at least one member of the decision-making team has not recently met the management of the companies we analyze or invest in.

Our approach is to forecast behind a veil of ignorance, i.e. to model companies’ behaviors across a wide range of possible scenarios. Our forward-looking analysis is not a mere set of static projections into the future, rather we attempt to engage in thought experiments that include the possible reactions of management as well as other stakeholders under different environments while accounting for the company’s track record in capturing value across business cycles as well as the long-term advancement of shareholders benefits.

Our portfolio construction process is mandate-specific, yet it remains predominantly governed by the allocation of risk subject to our investment thesis and major convictions. Our research process produces intrinsic value ranges that are unconventionally wide, which we believe serve our goal by:

- Challenging pre-established convictions

- Instilling capital allocation discipline that acts as a built-in risk management framework.

We would seek to eventually commit incremental capital as data emerges in support of our thesis and as the market gradually recognizes the identified value.

Each member strives to achieve independent superior knowledge of our portfolio companies and their value creation processes. We will periodically re-challenge our views in light of emerging fundamentals and market reactions.

Risk management in our investment process has three layers across all the mandates that we manage:

- Investment guideline driven risk management

- Top-down risk management layer at the overall portfolio construction level, in order to mitigate risk of overly concentrated conviction calls

- Bottom-up scenario-based stress testing of operating and financial forecasts

Team

Board of Directors

Sachin Mohindra Board Member

Carlos Roberto Board Member

Carlos Roberto

Board MemberCarlos Sagra is the Risk Officer as well as a Board Member at AD Investment Management and has oversight over risk and governance matters ensuring that best practice is followed. Carlos was previously responsible for market risk management at Ashmore Investment Management in London. Prior to this he held various roles in risk and other control functions on the sell side at HSBC, UBS, Morgan Stanley and Merrill Lynch in London. Carlos holds a Bachelor’s degree in Economics and Accounting from Bristol University (UK) and a Master’s degree in Financial Economics from Cardiff University (UK).

Management Team

Sachin Mohindra Senior Executive Officer

Danish Durrani Finance Officer

Danish Durrani

Finance OfficerDanish Durrani is the finance officer of AD Investment Management and is leading the Finance function at Abu Dhabi Investment Company (“Invest AD”). As Group Senior Finance Manager Danish oversees and is responsible for the financial and accounting functions. He brings over 18 years of professional experience in Finance, Banking and Auditing having worked in United Arab Emirates, Ireland and Pakistan in reputable regional and international institutions.

Danish joined from Istithmar World, the investment arm of Dubai World, handling financial accounting and group reporting.

Prior to joining Istithmar World, Danish has spent 5 years with Big4 audit firms mainly Ernst and Young (Dublin) and KPMG (Pakistan) handling some of their premier statutory audit accounts in financial services sector.

Danish is a qualified Chartered Accountant and a Fellow member of Institute of Chartered Accountants of Pakistan (ICAP), qualified the Chartered Institute of Management Accountants (CIMA) exams and holds Masters degree in Economics from University of Karachi.

Carlos Roberto Risk Officer

Carlos Roberto

Risk OfficerCarlos Sagra is the Risk Officer as well as a Board Member at AD Investment Management and has oversight over risk and governance matters ensuring that best practice is followed. Carlos was previously responsible for market risk management at Ashmore Investment Management in London. Prior to this he held various roles in risk and other control functions on the sell side at HSBC, UBS, Morgan Stanley and Merrill Lynch in London. Carlos holds a Bachelor’s degree in Economics and Accounting from Bristol University (UK) and a Master’s degree in Financial Economics from Cardiff University (UK).

Danielle Penton Compliance & MLRO Officer

Products & Strategies

Smart Beta Strategies

At its core, Smart Beta refers to mandates that passively replicate the performance of an active (factor weighted) index. Our objective is to provide institutional and qualified investors with cost-efficient exposure to investment themes that are based on pre-defined fundamental factors. Such factors are expected to deliver optimal investment returns over multiple market cycles. We leverage our extensive experience analyzing drivers of return in the MENA region in order to identify persistent and intuitive factors that form the basis of our proprietary methodologies rendered transparent through partnerships with globally renowned index providers.

Continuous Distribution Strategy

The strategy is a long-only balanced investment solution focused on MENA equities and fixed income that leverages our investment process of idea generation to create a low volatility portfolio that delivers attractive yields. Our objective is to provide institutional and qualified investors exposure to MENA capital markets with a predominant focus on yield, thereby enabling the fund to distribute quarterly cash returns. The strategy aims to create a continuous income stream for investors.

MENA Long Only Strategy

What we call internally “The MENA Sovereign Strategy”, is a MENA equities (long only) investment strategy that utilizes our investment process of idea generation while abiding by strict deviation limits relative to the benchmark. This strategy is offered through our UCITS compliant SICAV fund in Luxembourg, and adheres to additional investment guidelines that control its active risk, by imposing specific exposure limits. Our objective is to provide institutional and qualified investors a long exposure to the MENA Equity markets, building on our comprehensive investment process to drive long term outperformance over the benchmark. The strict exposure guidelines aim to intrinsically reduce volatility in alpha.

MENA Absolute Strategy

The strategy is a long/short purist MENA equity solution designed to provide absolute returns regardless of market direction. During different market cycles, the strategy will maintain specific tilts, long or short, driven by stock selection and a macro overlay. The strategy would also be able to hedge its convictions in MENA equities thereby resulting in (attempting to achieve ) lower volatility. The combination of the strategy’s tactical tilt at any given point in the cycle and its pair trades aim to generate a portfolio return that is significantly less volatile than that of the market. Our objective is to provide institutional and qualified investors an absolute return investment solution which delivers returns in excess of risk free rate per unit of total risk.

Contact

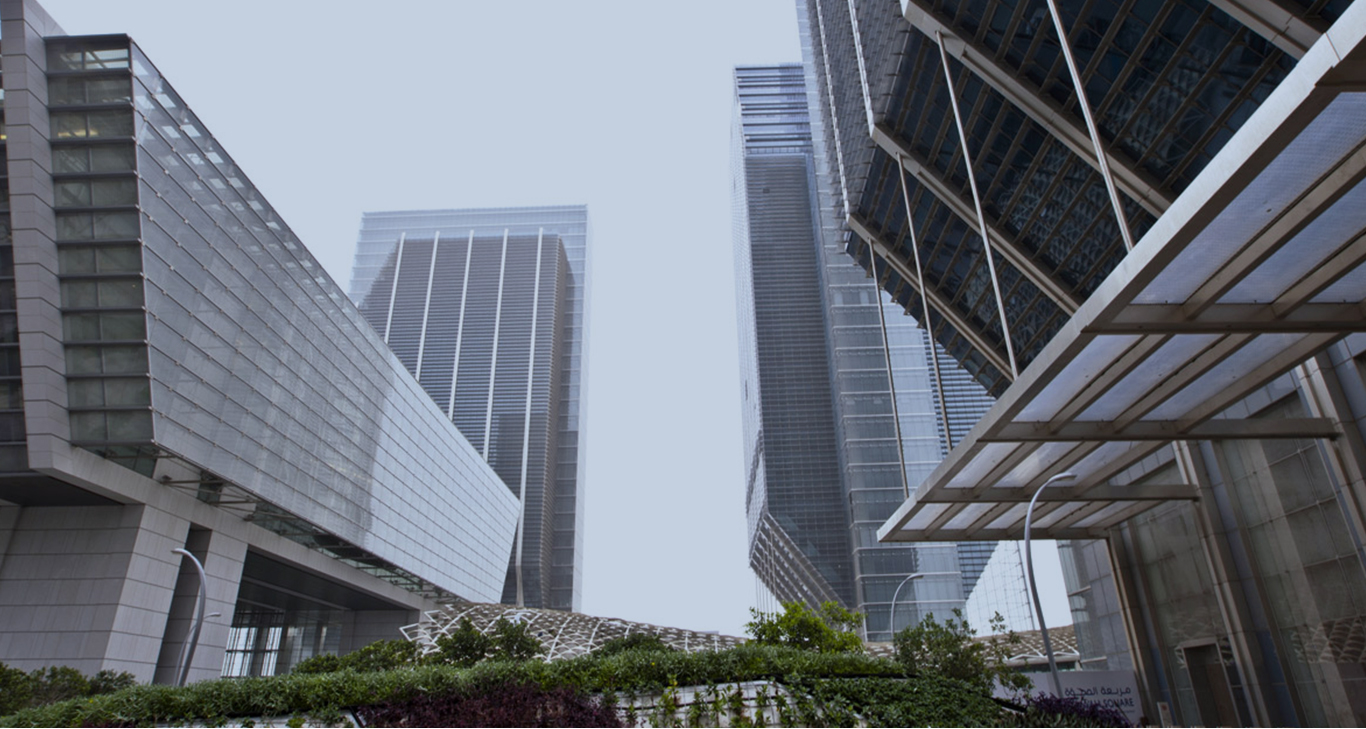

Tamouh

Al Reem Island, Abu Dhabi, United Arab Emirates

PRIVACY POLICY AND DISCLAIMER

Privacy policy - We respect your right to privacy and will protect it when you visit our website. The website collects no personal information about you when you visit our website unless you specifically and knowingly choose to provide such information. If you choose to provide information to us, we use it only to fulfill your request for information or services.

Linking policy and disclaimer of endorsement - This internet site contains hypertext links to information created and maintained by other public and private organizations. These links are provided for your convenience. The website does not control or guarantee the accuracy, relevance, timeliness, or completeness of this outside information. Further, the inclusion of links to particular items in hypertext is not intended to reflect their importance, nor is it intended to endorse any views expressed, or products or service offered on these outside sites, or the organizations sponsoring the sites.

Important information - This material is provided by AD Investment Management Limited (ADIM), which is a subsidiary of Invest AD (Abu Dhabi Investment Company). Address: Office 3419, Floor 34, Al Maqam Tower, ADGM Square, Al Maryah Island, Abu Dhabi, UAE. The analyses and opinions expressed in this material represent the subjective views of the author or ADIM, as of the date indicated, may no longer be current, and are subject to change without notification as a result of market events or other conditions. There can be no assurance that developments will transpire as forecast in this material. This material is for information purposes only to institutional investors. The provision of this material and/or reference to specific securities, funds, investment services, sectors, or markets within this material does not constitute investment advice, or a recommendation or an offer to buy or to sell any fund or security, or an offer of service. Investors should consider the investment objectives, risks, and expenses of any investment carefully before investing. This material may not be distributed, published, or reproduced, in whole or in part without the express permission of ADIM.

Contact disclaimer - Please be alert and confirm the authenticity of any emails or documents you receive that purport to be from ADIM. Please note, all Invest AD emails use our company email format: first-letter-of-the-first-name, family-name@adim.ae. Please check the spelling of all email addresses carefully. ADIM is not responsible for any communications sent by an unauthorized individual. ADIM cannot and will not honor any commitments or promises made by an unauthorized individual. If you have any questions about this or want to notify us of any suspicious communication, please contact us at: fraudreport@investad.com.